Ethereum Price Prediction as Bulls Hold $1,500 Level – Can ETH Rally Soon?

Ethereum Price Prediction as Bulls Hold $1,500 Level – Can ETH Rally Soon?

The second-largest cryptocurrency, ETH is stable as it embraces support at $1,500 however, analysts believe a recovery is unlikely ahead of the scheduled Shanghai hard fork. Ethereum price dodders at $1,555 at the time of writing amidst a -1% change in 24 hours.

Investors who locked their ETH in the Beacon Chain smart contract to help the network transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus algorithm are expected to withdraw the tokens when the Shanghai hard fork comes in early April.

Analysts appear conflicted over the impact of the much-awaited upgrade with some saying it would send Ethereum price above $2,000 while others foresee a further drop in price as stakers gain access to their ETH locked in the smart contract and prefer to sell.

Ethereum Price Wobbles Above $1,500 as Recession Fears Mount

The crypto market sustained the position it has kept for the last couple of weeks at the very edge of a cliff as the Federal Reserve Chair Jerome Powell testified before the Senate Banking Committee on Tuesday.

Powell did not mince his words when he said that interest rates were most likely to rise and by a larger margin than expected by market watchers, citing extremely unfavorable economic data since the previous review in early February.

The crypto market is expected to feel the pinch with bearish forces likely to be on the offensive, as investors digress toward fixed-income products and the strengthening US dollar. Powell’s remarks have been interpreted as a warning of a recession beckoning – if it is not already here.

Ethereum price and the crypto market must also brave the tough stance from US regulatory agencies, which have vowed to increase oversight of the industry following the sudden collapse of FTX exchange in November.

US-based crypto firms are feeling the pressure – made worse by the recent revelation that crypto-friendly bank, Silvergate is evaluating its weakening capital position to survive.

Dissecting the Ethereum Price Short-Term Technical Outlook

In addition to Ethereum price staying stable above $1,500, the smart contracts token holds onto support provided by the 200-day Exponential Moving Average (EMA) at $1,546 on the daily chart.

However, the lack of liquidity means ETH price does not have the requisite momentum to battle the immediate seller congestion $1,569, as reinforced by the 50-day EMA (line in red). The position of the Money Flow Index (MFI) below the descending trend line implies that bears hold the reins.

The MFI is a momentum indicator closely related to the Relative Strength Index (RSI) as it tracks the flow of money in and out of an asset like ETH over a specified period by incorporating volume and not price.

Oversold levels would be expected below 20.00, hence Ethereum price could drop further before a trend reversal ensues. Traders looking forward to booking long positions in ETH may want to wait until the MFI breaks above the trend line, as illustrated in the chart.

That’s not all as Ethereum price faces more pressure from a sell signal from the Moving Average Convergence Divergence (MACD) indicator. This call to traders to offload ETH manifested in early February as crypto markets corrected from January’s aggressive bullish push.

The MACD’s recent slide beneath the mean line at 0.00 hints at bears having the upper hand. In that case, support at the 200-day EMA must be protected at all costs, otherwise, we could see Ethereum price dropping to $1,400.

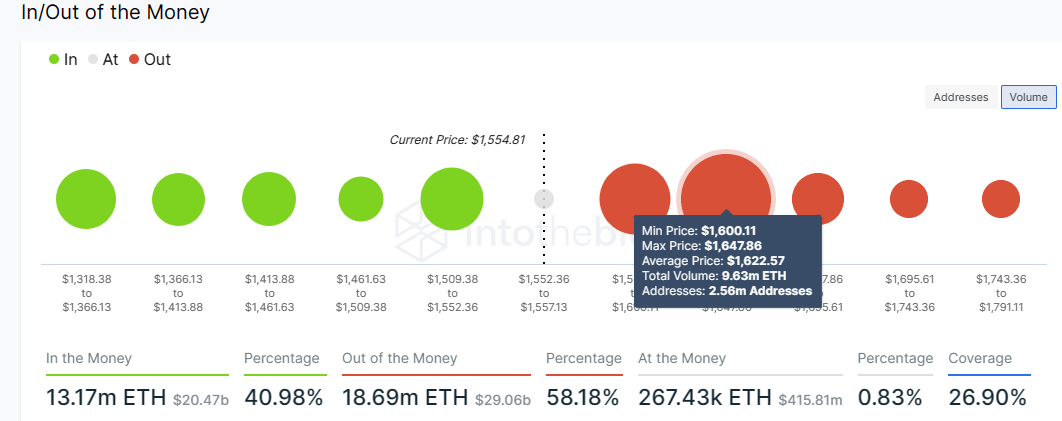

As per blockchain data presented by IntoTheBlock, around 18.69 million ETH addresses are currently in a loss situation. This indicates that if these investors sell their ETH at the current market price, they will experience a loss compared to their initial purchase price.

Retail investors may sell their crypto holdings to protect their capital and invest in better-performing tokens, even at a loss. The support areas (green circles) available for Ethereum price are weak, with a strong hurdle to overcome in the range between $1,600 and $1,647.

Addresses in the money with unrealized profits are represented by small green circles on the chart, and if selling pressure increases, Ethereum price may fall to retest downstream levels at $1,400 and $1,338, respectively.

The large circle between $1,600 and $1,647 is where sellers are most concentrated and where bulls may face resistance as they push for an uptrend. If the price of Ethereum goes up, investors may sell at their breakeven points, potentially slowing down or even reversing the upward trend.

However, if the price breaks above the $1,600 to $1,647 resistance area, it could lead to a surge toward $1,800 and beyond. Meanwhile, key levels for traders to watch on the upside are the seller congestion at $1,600, $1,800, and ultimately $2,000 in the short term.

Buy Ethereum Now.

Ethereum Alternatives to Buy Today

If you're looking for other high-potential crypto projects alongside ETH, we've reviewed the top 15 cryptocurrencies for 2023, as analyzed by the CryptoNews Industry Talk team.The list is updated weekly with new altcoins and ICO projects.

See the 15 Cryptocurrencies

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

Related Articles:

Terra Luna Classic Price Prediction as $50 Million Trading Volume Comes In – Can LUNC Recover This Year?US Bankruptcy Judge Approves Binance.US $1.3B Deal for Voyager Digital, but Hurdles Remain – Here's the LatestShiba Inu Price Prediction as Shibarium Public Beta Launch Approaches – Is a SHIB Pump Coming?